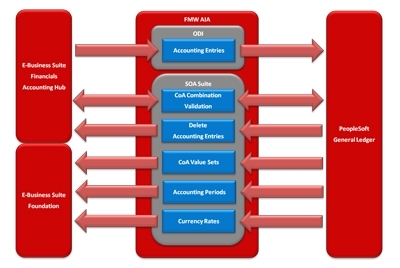

With a vast array of expertise and partnerships, our team is ready to help you navigate the hotel and accounting industries with cutting-edge tools and invaluable experience. Accountants communicate with their team and vendors regarding financial statements, submitting reports or logs to ensure accuracy and transparency. An operations-management platform that allows hoteliers to import data into a centralized dashboard can aid in identifying trends and making more informed decisions. More importantly, the solution complies with multiple regulatory financial requirements, including GAAP, SOX, ASC 606, and more. It also ensures compliance with tax codes, government regulations, internal policies, and other accounting standards. What I outlined was a way we could work together to create his own custom company manual.

By utilizing streamlined software systems and minimizing the number of steps required for each audit, hotel owners can maximize their time and resources on more valuable endeavors. M3 prides itself on being a source of industry best practices and accounting knowledge. Whether routine training or seeking continuing education credits, M3 is a hotelier’s one-stop-shop for learning. All of M3’s hospitality software solutions come with the knowledge and experience of M3’s expert customer support team. Backed by decades of combined experience, M3 boasts a recurring customer satisfaction rating in excess of 95%. M3 provides a best-of-suite solution allowing hoteliers to dramatically reduce the number of systems required at the corporate level.

Keep on top of your hotel and restaurant accounting

A bit more discussion revealed that his hotel company did not have a completed accounting policy manual. I suggested I could help him create a custom policy manual for his hotels. I told him I had worked with other clients and had developed a standard set of hotel-specific accounting policies. Keeping on top of your accounting doesn’t have to be daunting or time-consuming. By following these basic hotel and restaurant accounting tips, it’s easy to take the reins and manage your accounting in-house with the help of your management team. Plus, with the help of your POS and an accounting system, you can ensure that your business’s financial records are accurate and up-to-date.

Irish Hotel Industry Warns About Shortage Of Hotel Rooms To Meet … – Hospitality Ireland

Irish Hotel Industry Warns About Shortage Of Hotel Rooms To Meet ….

Posted: Mon, 21 Aug 2023 12:01:46 GMT [source]

FreshBooks is capable of streamlining routine accounting activities such as billing and making them seamless in nature. Moreover, the software presents you with a collection of features through a neat, intuitive interface. You can customize it to present accounting features according to your personal preferences.

Why Outsource Accounting for Your Hotel?

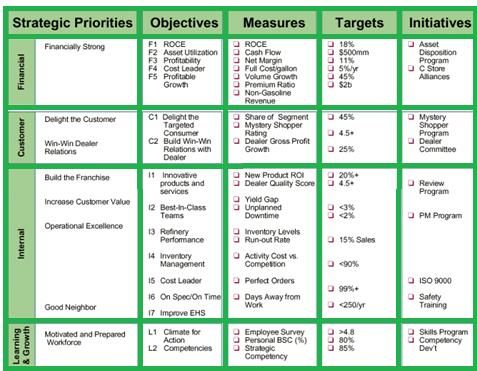

In addition to accounting for small businesses, you can take advantage of our team of financial experts, including tax professionals, when you choose comprehensive financial management with FinancePal. The policies are the black and white structure you want in place so people can clearly see the rules of the financial road. Making the rules simple, clear and understood is the key to creating a strong financial culture in your hotel and hotel company. You also want concise policies so you have the basis for an effective internal control review process. More on setting up and using an internal control review process is coming in a future article. Quite often hotel financial executives and managers confuse accounting policy with procedures.

Expenses The cost of assets consumed or services used in the process of earning revenue. The same struggle applies when it comes to managing property finances and business accounts. Other powerful features of Freshbooks also allow you to add discounts, request deposits, and automate late payment reminders and fees. The solution supports online payments, enabling you to send invoices to your clients via email and accept their payments through various types of payment methods.

What is the best hotel back office accounting software?

It has financial management and business intelligence tools that you can use to streamline your accounting tasks and make more informed decisions. The system also helps you manage your portfolio of hotels and restaurants more efficiently with its project accounting tools. QuickBooks is an industry-leading accounting software that offers a vast array of financial insights and organizational capabilities. The solution also allows you to connect your invoices to credit cards or bank transfer accounts to streamline payment transactions. QuickBooks Enterprise offers best-in-class accounting and financial management tools.

In simple terms, there’s much more financial data to document, organize, and analyze in the lodging industry than in most others. This involves analyzing hotel earning and spending data to assess the financial health of the business and create performance summaries, allowing managers to make informed business decisions. To understand the fundamentals of financial management in hotel operations, we talked to Annia Silva [2], front office manager at a full-service luxury hotel. With her insights and our research, we’ve put together this blog to help you grasp the financial side of this industry. Similarly to your accounts payable, many accounting systems also run employee payroll. This makes it easy to set up employee profiles and input their salary and benefits so they always receive what they’re entitled to.

Accounting for Hotels (With Accounting Entries) Hotel Accounts

It generally does a better job of measuring your company’s cash flows than its actual profitability. As a result, it’s usually only suitable for small hotel businesses like bed and breakfasts. All businesses in the United States follow the same fundamental accounting principles, but their application varies between industries.

Whereas, the hotel accounting services eliminate this situation, letting the accountants create and access the statement in seconds. The purpose of this financial statement is to help hotel business investors & creditors assess the past and future financial performance, unveiling the capability of generating and optimizing the cash flows. These areas must be closely monitored in order to ensure the correct running of a hotel. This accounting software focuses on boosting performance through leveraging computing power. Hence, it is designed to provide technological support for every step of your hotel portfolio. This digital tool is also designed such that it delivers accounting and analytics at the same time Furthermore, you can use it to create some service standards across a large chain of hospitality facilities.

Streamline Night Audits

Freeing the administrative burden on managers and accountants will help them unleash their potential to the fullest. In this blog, we would love to elaborate on all that hotel accounting entails and define its importance. (i) Separate accounts have to be maintained for receipts like Wines, Beer and Spirits etc. and payments made against them, the balance being transferred to Profit and Loss Account. Usually sales taxes are paid by the occupant on various items at the rates framed by the State Government and the same is deposited at regular intervals to the State Government. Similarly, Hotel Expenditure Tax (HET) is levied by some luxury hotels- on the bills (including Sales Tax) @ 10% which is to be submitted to Central Government. This leads to more manual data entry — leading to errors and inaccuracies with sales.

Being versatile, it can provide accounting assistance for small hotels as well as large enterprises. The software also boosts the collection of revenue and assists with managing hotel property. An interesting feature of this digital tool is that it can be integrated with a web-booking engine. Last but not least, it can be manipulated through a dedicated smartphone application. You can try out the software for free over a limited trial period of 15 days.

While numerous bookkeeping templates are available for hotel and restaurant owners, there are four essential templates every business should have to keep on top of their finances. When you’re researching the best accounting software for your business, it’s important to ensure it will seamlessly integrate with your point of sale (POS) system. For example, the more basic packages will offer payroll for a small number of staff Hotel accounting and have a cap on invoicing. Whereas premium plans will provide payroll services for more staff and include unlimited invoicing and bulk reconciliations. Therefore, it’s essential to research your options to ensure you’re opting for the right service at the best price. It’s important to take the time to run through the features of each accounting system to see which best meets the needs of your hotel or restaurant.

Setting room rates is one of the most unique and complex aspects of hotel accounting. Though software exists that can organize the necessary data and help with the challenge, it’s not perfect, and human input is still often needed. The fundamental challenge of accounting for hotel operations is relatively straightforward.

- In this way, you can keep your books accurate and up-to-date at all times.

- Certain seasons in different properties will have busier periods that will drive costs up.

- Forecasting in business involves the use of data and tools to make informed predictions about business metrics and developments.

- It provides a wide range of tools to accommodate your core financial operations.

- Revenue management starts with a general strategy, which serves as the foundation for rates, policies, distribution, and marketing activities.

These systems can help you to keep track of revenue and expenses, control costs, and analyze financial performance. Depending on your needs, accounting software can even provide you with an inventory or point-of-sale system for your business. Xero is an online accounting solution that recognizes the needs of hotel businesses to simplify accounting tasks. It provides an array of powerful accounting features, from tracking bills and expenses, sending invoices, quotes, and estimates, to managing projects, and streamlining the entire accounting process. It also simplifies financial transactions by letting you connect the app to your bank.