Adjusting entries usually involve one or more balance sheet accounts and one or more accounts from your profit and loss statement. In other words, when you make an adjusting entry to your books, you are adjusting your income or expenses and either what your company owns (assets) or what it owes (liabilities). Adjusting entries are made at the end of the accounting period to make your financial statements more accurately reflect your income and expenses, usually — but not always — on an accrual basis. An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. If you don’t make adjusting entries, your income and expenses won’t match up correctly.

Get in Touch With a Financial Advisor

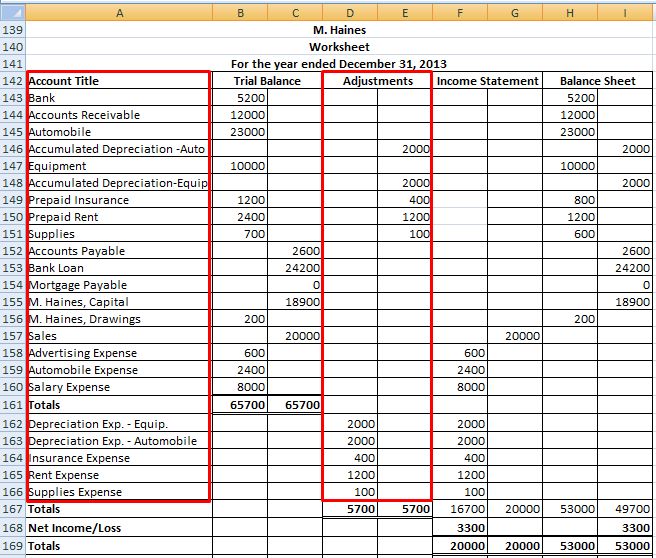

The required adjusting entries depend on what types oftransactions the company has, but there are some common types ofadjusting entries. Before we look at recording and posting the mostcommon types of adjusting entries, we briefly discuss the varioustypes of adjusting entries. He does the accountinghimself and uses an accrual basis for accounting.

Booking the Journal Entries

More specifically, deferred revenue is revenue that a customer pays the business, for services that haven’t been received yet, such as yearly memberships and subscriptions. The other deferral in accounting is the deferred revenue, which is an adjusting entry that converts liabilities to revenue. If you haven’t decided whether to use cash or accrual basis as the timing of documentation for your small business accounting, our guide on the basis of accounting can help you decide. For example, let’s assume that in December you bill a client for $1000 worth of service. They then pay you in January or February – after the previous accounting period has finished.

The Process of Recording Adjustment Entries

Adjusting entries are changes to journal entries you’ve already recorded. Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods. For tax xero certification for accountants purposes, your tax preparer might fully expense the purchase of a fixed asset when you purchase it. However, for management purposes, you don’t fully use the asset at the time of purchase.

What Is an Adjusting Journal Entry?

During the accounting period, the office supplies are used up and as they are used they become an expense. When office supplies are bought and used, an adjusting entry is made to debit office supply expenses and credit prepaid office supplies. Prepaid expenses refer to assets that are paid for and that are gradually used up during the accounting period. A common example of a prepaid expense is a company buying and paying for office supplies.

Bookkeeping and accounting software

- Under accrual accounting, revenues and expenses are booked when the revenues and expenses actually occur instead of when the cash transaction happens.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Adjusting entries requires updates to specific account types atthe end of the period.

- In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided.

- This can happen when transactions are not recorded in a timely manner or when they are recorded incorrectly.

Adjustment entries can also impact a business’s stock-based compensation expenses. Understanding adjustment entries is critical for anyone involved in accounting, finance, or business operations. There are several types of adjustment entries, including accruals, deferrals, estimates, and reclassifications.

Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. With cash accounting, this occurs only when money is received for goods or services. Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit).

These transactions must be dealt with properly before preparing financial statements. For example, a company that has a fiscal year ending Dec. 31 takes out a loan from the bank on Dec. 1. The terms of the loan indicate that interest payments are to be made every three months. In this case, the company’s first interest payment is to be made on March 1.