They report each shareholder’s share of income, losses, deductions, and credits. The shareholders use the information on the K-1 to report the information on their separate tax returns. The partnership will provide a statement showing the amounts of each type of income or gain that’s included in inversion gain. The partnership has included inversion gain in income elsewhere on Schedule K-1.

responses to “I Received a K-1. What Is It?”

If you’re an individual and the passive activity rules don’t apply to the amounts shown on your Schedule K-1, take the amounts shown and enter them on the appropriate lines of your tax return. If the passive activity rules do apply, report the amounts shown as indicated in these instructions. Only individuals, qualifying estates, and qualifying revocable trusts that made a section 645 election can actively participate in a rental real estate activity. Estates (other than qualifying estates), trusts (other than qualifying revocable trusts that made a section 645 election), and corporations can’t actively participate. Limited partners can’t actively participate unless future regulations provide an exception.

How to Report Self-Employment Income When You Have Mult…

All securities involve risk and may result in significant losses. Form W-9 doesn’t usually result in income taxes withheld, but there is an exception. Our team of bookkeepers and tax professionals automate your financial reporting and tax filing all year round.

Where is a K-1 Reported on Your Individual Returns?

The corporation will identify the type of credit and any other information you need to figure these credits from rental real estate activities (other than the low-income housing credit and qualified rehabilitation expenditures). If the credits are from more than one activity, the corporation will identify the credits from each activity on an attached statement. See Passive Activity Limitations , earlier, and the Instructions for Form 8582-CR for details.

Furthermore, like individuals, partnerships can request extensions of time to file, often until September 15. Businesses operating on the calendar year must file Form 1065 by March 15 (unless you file for a 6-month extension using Form 7004). March 15 is also the deadline for partnerships to issue individual Schedule K-1s to each partner, which will give individual partners a little under a month to file their personal federal income tax returns on April 15. These deadlines move to the next business day if they fall on a weekend or holiday. In other words, 1099 forms are relevant for reporting the income of the partnership as a whole.

However, some trusts and estates pass income through to the beneficiaries. This https://www.bookstime.com/articles/what-is-payroll-expense depends on the type of income and the governing documents of the trust or estate. For example, a trust might pass through dividends, interest, and other income to the beneficiaries but pay tax at the trust level on capital gains. So, partners and co-owners must report their share of income, losses, and tax deductions and credits. If you have an ownership stake in a limited liability company (LLC), then you may receive a Schedule K-1.

- Whether you deduct the expenditures or elect to amortize them, report the amount on a separate line of Schedule E, line 28, column (i), if you materially participated in the partnership activity.

- If the amount on this line is a loss, enter only the deductible amount on Schedule SE (Form 1040).

- Investment advisory services are only provided to clients of YieldStreet Management, LLC, an investment advisor registered with the Securities and Exchange Commission, pursuant to a written advisory agreement.

- Use Form 8697, Interest Computation Under the Look-Back Method for Completed Long-Term Contracts, to report any such interest.

- Include your share of the partnership’s section 179 expense deduction for the year even if you can’t deduct all of it due to limitations.

In addition, basis may be adjusted under other provisions of the Internal Revenue Code. You should generally use Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations, to figure your aggregate stock and debt basis. If you are required to file Form 8082 but don’t do so, you may be subject to the accuracy-related penalty. This penalty is in addition to any tax that results from making your amount https://x.com/BooksTimeInc or treatment of the item consistent with that shown on the corporation’s return. If you are in a real estate partnership and you are allocated a share of the debt, you should most likely be allocated qualified non-recourse instead of non-recourse debt.

Podcast: Can I Deduct That? Tax Tricks for Influencers

- This represents the amount of loss or deduction items you’re allowed to report on your return from the partnership this tax year, as limited by your basis.

- For your protection, this form may show only the last four digits of the TIN in items E and H2, as noted under Purpose of Schedule K-1, earlier.

- After applying the limitations on losses and deductions, report collectibles gain or loss on line 4 of the 28% Rate Gain Worksheet—Line 18 in the Instructions for Schedule D (Form 1040).

- This is your net loss from involuntary conversions due to casualty or theft.

- These losses and deductions include a loss on the disposition of assets and the section 179 expense deduction.

- For this reason, it’s generally best to avoid these kinds of investments in a retirement account.

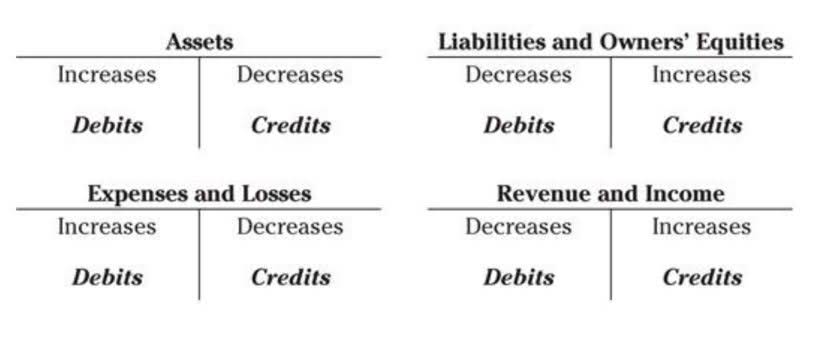

It breaks down your share of a partnership’s income, deductions, and credits. Enter your share of the ordinary income what does k1 mean (loss) from trade or business activities of the partnership this year here. Here you’ll report your share of the partnership’s profits, loss, and capital.