ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. This pattern is found at the end of the uptrend when supply and demand factors are equal. The word Doji is of Japanese origin types of doji candlestick which means blunder or mistake that refers to the rarity of having the open and close price be exactly the same. Gravestone doji has a long upper shadow, but it doesn’t have a lower shadow. Classic Doji has short shadows in both directions and expresses indecision.

Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make. The size of the doji’s tail or wick coupled with the size of the confirmation candle can sometimes mean the entry point for a trade is a long way from the stop-loss location.

Questions to Ask When You Spot a Doji Pattern

Depending on what the preceding candlestick patterns are telling you, it may indicate a price reversal. This is often the case when they’re observed during a strong upward or downward trend, as they show that the market is now becoming indecisive following the recent trend. Doji candle is a candlestick pattern that indicates market neutrality. Market neutrality means that buyers and sellers will cancel one another out, resulting in no net price movements for a given trading period. When this happens, the Doji candlestick pattern emerges on the trading chart. Other technical techniques, like other candlestick patterns, technical analysis indicators, or strategies should be used with this candlestick pattern for making trading decisions.

Forex Candlestick Patterns Cheat Sheet – Benzinga

Forex Candlestick Patterns Cheat Sheet.

Posted: Tue, 15 Nov 2022 20:26:19 GMT [source]

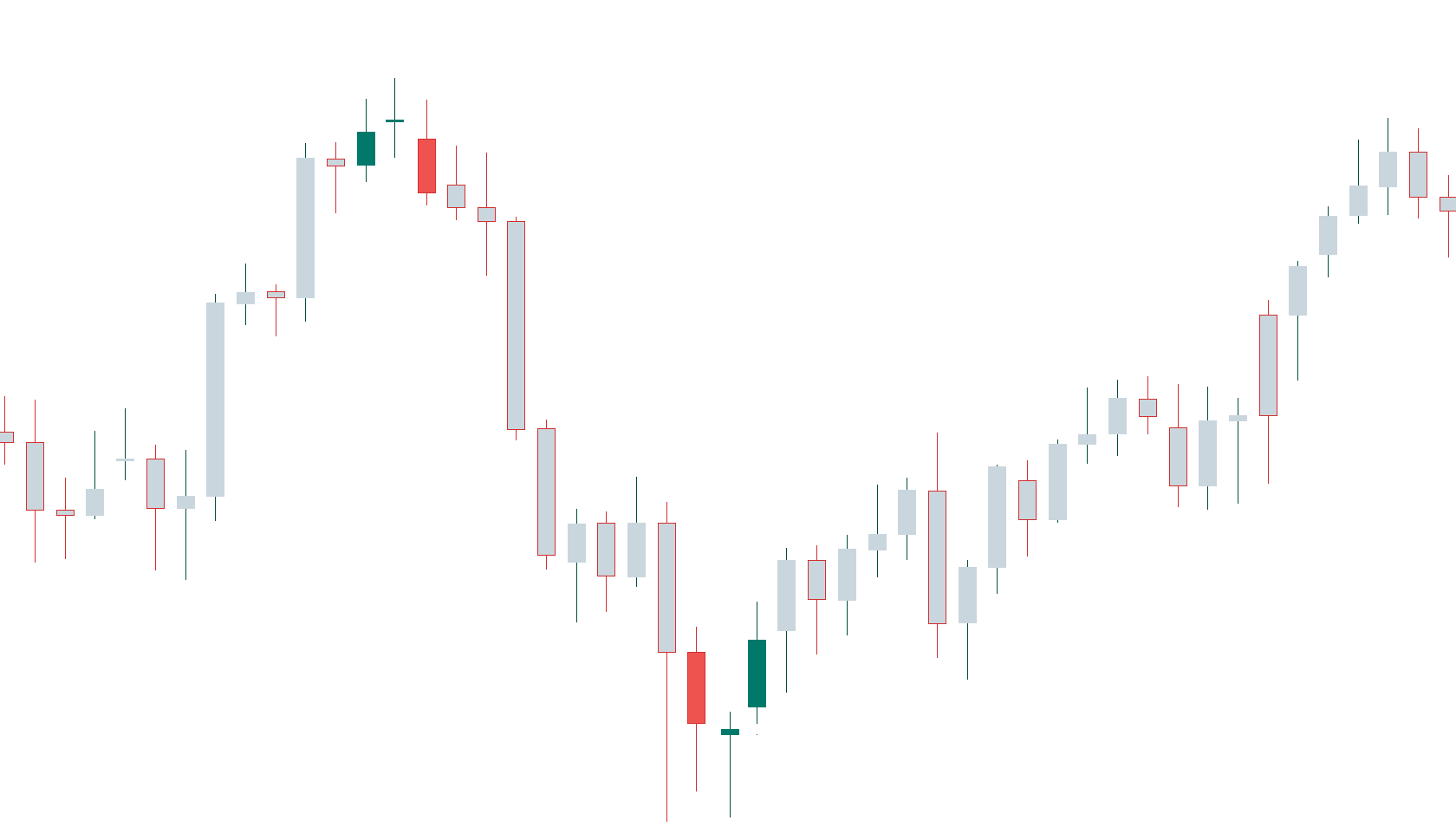

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. The below price chart for US SPX 500 index shows a bearish star doji marked the start of a short-term down move, following a rally in price. The Doji Candlestick Pattern can often be seen below the trend, which is mainly seen as a sign of possible price reversal. Also, the Doji Candlestick Pattern appears primarily as a continuous pattern. The Doji candlestick pattern can lead to high profits in trading.

Doji candlestick pattern summed up

Additionally, the momentum technical indicator at the bottom of the chart went sideways when the Moving Average (MA) was going upward, warning the tiredness of the market. Furthermore, a candle before this doji has a small body and relatively long tails, which is another reversal warning. Following the dragonfly, the price proceeds higher on the following candle, confirming the price is moving back to the upside. Traders would buy during or shortly after the confirmation candle. The Gravestone Doji candle shows that the buyers were strong initially but the bears took over and caused the price decline indicating the strength of the bear market. However, it is important to consider this candle formation in conjunction with a technical indicator or your particular exit strategy.

- This type of Doji candlestick pattern shows a lot of hesitation between sellers and buyers in the marketplace.

- Though it is not entirely reliable because a Doji candlestick pattern also indicates that buyers and sellers are gaining momentum.

- A doji is a name for a candlestick chart for a security that has an open and close that are virtually equal.

- The privacy and protection of your data and information provided to us is of vital importance.

Each candlestick chart pattern says something about the strength of the buyers and sellers within this timeframe. A long green daily candlestick may indicate that the buyers were strong that day, whereas a long red candle may indicate that sellers were strong. The Doji candle is an invaluable signal for traders who wish to examine the market conditions. This comes from the fact that most traders use historical data and real-time price movement to search for signals.

Using a Doji to Predict a Price Reversal

The Long-Legged Doji indicates that there was more volatility between the high and low prices in the trading session than the neutral Doji. In the below chart of Mayur Uniquoters Ltd, we can see that at the end of the uptrend, a Doji candle is formed, indicating that the ongoing trend has become certain. After a long period of a downtrend or an uptrend, doji should be taken into series. Because doji means indecision and after a long period of the trip the chance of coming back increases.

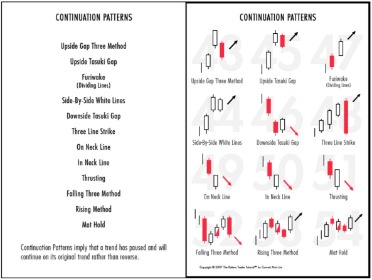

A Flicker of Light: Candlestick Reversal and Continuation Patterns – The Ticker Tape

A Flicker of Light: Candlestick Reversal and Continuation Patterns.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

Popularly known as the ‘doji candle’, the doji candlestick chart pattern is one of the most unique formations in the world of trading. Learn more about this pattern and find out how you can trade when you recognise it. A doji candle is dominated by wicks with very small bodies or no bodies at all.

Reading Candlestick Charts

In the trading opportunities, most of them look for a higher frame than the lower frame. The concept of these Doji candlestick patterns can be seen across different timeframes. A spinning top also signals weakness in the current trend, but not necessarily a reversal.

Neutral patterns indicate that buying and selling are almost the same and the future direction of the trend is uncertain. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money. Nevertheless, a doji pattern could be interpreted as a sign that a prior trend is https://g-markets.net/ losing its strength, and taking some profits might be well advised. But, if you take it into context with the earlier price action, you’ll have a sense of what the market is likely to do with the doji pattern. Because in this post, I’ll reveal the answers and teach you everything I know about the Doji candlestick pattern — so you can finally trade it like a pro.

Example of How to Use the Dragonfly Doji

Of its variations, the dragonfly doji is seen as a bullish reversal pattern that occurs at the bottom of downtrends. The gravestone doji is read as a bearish reversal at the peak of uptrends. The thick body of a candlestick shows the opening and closing prices. If the close is higher than the open, the candle is colored white or green. The candle is colored red or black if the open is below the close.

As the market swings south, the tombstone Doji signals that the bears have regained control. For example, if you think that a common doji at the bottom of a downtrend means possible reversal, you can test the bullish bias using the stochastic oscillator. This indicator follows the speed and momentum of the market over a specific timeframe, predicting price movements. The pattern can be found across any time frame but has greater significance on longer-term charts as more participants contribute to its formation.

Open and close at the same level when the market opens, buyers get control and it rises and becomes up and gain come down to close it is bearish. To learn more about the new trading strategy and doji formation that lets you profit in bull and bear markets so you grow your wealth steadily even during a recession. Though many people search about bullish candle patterns, here this article helps you to know more about the Doji Candlestick Pattern and how to come across the trading market.

At this point it is crucial to note that traders should look for supporting signals that the trend may reverse before executing a trade. The chart below makes use of the stochastic indicator, which shows that the market is currently in overbought territory – adding to the bullish bias. This formation, which looks like a small horizontal line, signals the possibility of a super bearish or bullish trend at the start of the stock. This pattern does not appear from time to time, but when it does appear on the charts, traders should be prepared for large one-way movement in the counter. It signifies stocks or other financial assets that open and close at a day’s lows. The upper and longer side of the Gravestone Doji, also called a shadow, signals at a possible end in the opposite direction to the market’s current trend and reverses in direction.